The Tale of Two Dads

Discover the powerful money lessons from Robert Kiyosaki's Rich Dad Poor Dad. This post explores how rich and poor parents teach their children about money, highlighting key differences in mindset, asset building, and financial education. Learn how to break free from the rat race and build wealth by adopting the principles of the Rich Dad.

I grew up with two father figures:

-

Poor Dad—my biological father.

-

Rich Dad—my best friend Mike’s dad, a successful businessman and investor.

Both were intelligent. Both were hardworking. But they had very different philosophies about money, and the contrast taught me everything.

MINDSET: How They Think About Money

Poor Dad's Belief:

“Money is the root of all evil.”

He believed in job security, saving money, and climbing the corporate ladder. He feared making mistakes and believed that education = good grades = good job = a secure life.

He told me:

“Go to school, get a good degree, find a secure job, work hard, save money, and retire with a pension.”

Rich Dad's Belief:

“The lack of financial education is the root of all evil.”

He believed in financial education, entrepreneurship, investing, and building systems that generate cash flow. He encouraged learning through experience, including failure.

He told me:

“Don’t work for money—make money work for you.”

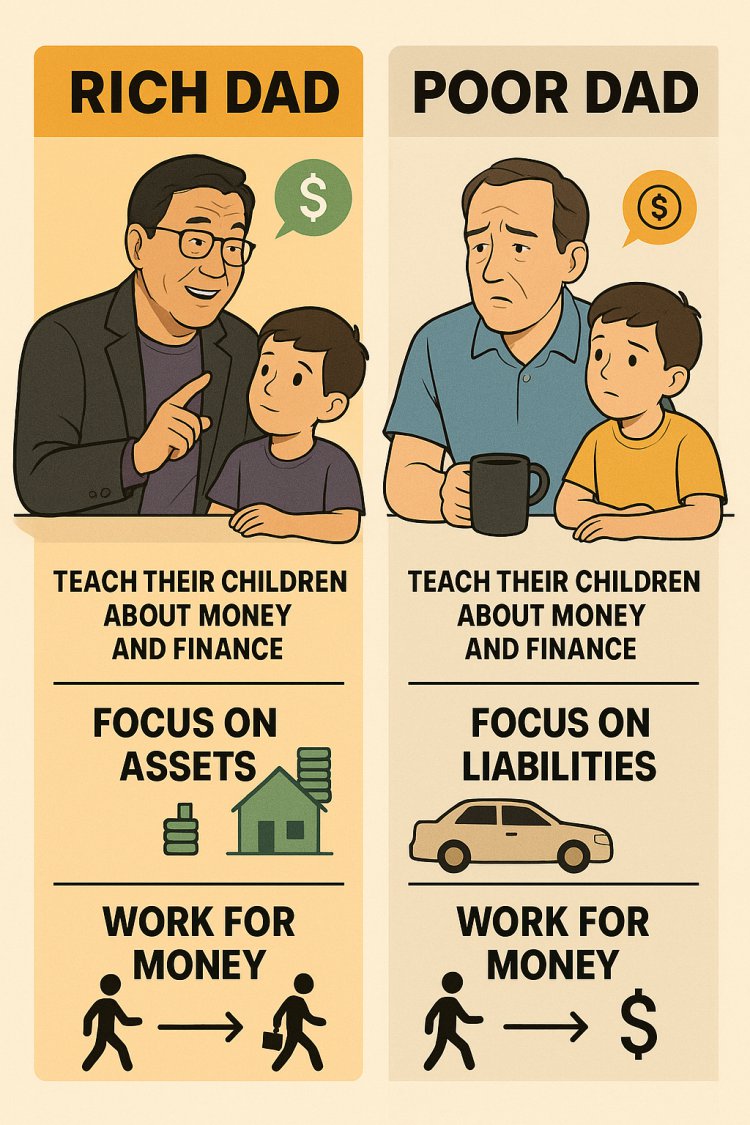

HOW THEY TAUGHT THEIR CHILDREN ABOUT MONEY

Poor Dad:

-

Taught me to value stability and security.

-

Avoided talking about money—thought it was rude or taboo.

-

Believed working hard for a paycheck was noble.

-

Saw the house as an asset (even if it was a liability).

-

Avoided risks and debt like the plague.

Lesson to his kids:

“Study hard so you can work for a good company.”

Rich Dad:

-

Made money a daily conversation.

-

Encouraged me to start small businesses, sell comics, run errands for a fee.

-

Taught me to read financial statements, understand cash flow.

-

Explained the importance of assets vs. liabilities.

-

Said debt is a tool, if you learn how to use it wisely.

Lesson to his kids:

“Study money so you can own the company.”

THE CORE DIFFERENCE: ASSETS VS. LIABILITIES

Rich Dad said: “The rich acquire assets. The poor and middle class acquire liabilities they think are assets.”

Let me explain:

| Assets | Liabilities |

|---|---|

| Put money in your pocket | Take money out of your pocket |

| Examples: Rental properties, stocks, businesses, royalties | Examples: Car loans, big houses, credit card debt |

THE CASHFLOW PATTERN

Poor Dad:

-

Earn → Spend → Leftover (maybe save)

Rich Dad:

-

Earn → Buy Assets → Assets generate income → Reinvest income

RAT RACE VS. FINANCIAL FREEDOM

Poor Dad lived in the rat race.

He worked harder to earn more, but his expenses increased just as fast (or faster). The result? Trapped.

Rich Dad focused on financial freedom.

He built streams of income that worked whether he showed up or not. That’s how he became free.

WHAT THEY TAUGHT ME ABOUT SCHOOL

-

Poor Dad: “Go to school to get a job.”

-

Rich Dad: “Go to school to learn, but don’t rely on it to get rich. Learn about money outside the classroom.”

Financial Education = The Real Power

In school, we’re taught:

-

Algebra

-

Shakespeare

-

History

But not:

-

How to read a balance sheet

-

How to invest in real estate

-

How to minimize taxes

-

How to manage debt

-

How to build wealth

Rich Dad filled in those gaps.

FINAL WORDS OVER COFFEE

“It’s not your income that makes you rich. It’s what you do with it.”

You can earn $100,000 a year and stay broke if you only buy liabilities.

You can earn $30,000 a year, invest wisely, and become wealthy.

✅ ACTION STEPS FOR YOU

-

Start tracking your income and expenses.

-

Ask yourself before any purchase: Is this an asset or a liability?

-

Start building assets now (business, rental property, stocks, intellectual property).

-

Invest in financial education—read, ask, observe, and learn.

-

Don’t fear failure. Fear financial ignorance.

☕ "Thanks for the coffee chat. If you take the path of Rich Dad, you’re not just working for money — you’re building a future where money works for you."

What's Your Reaction?