Financial Mistakes New Business Owners Make

Avoid the pitfalls that sink 20% of startups in their first year. Learn the critical financial mistakes new business owners make and how to build a lasting legacy.

The dream of entrepreneurship is often painted in strokes of innovation, leadership, and freedom. However, the canvas upon which that dream is painted is made of cold, hard numbers. Statistics from various global bureaus of labor and commerce consistently show a sobering reality: approximately 20% of new businesses fail within their first year, and nearly 50% vanish by the end of their fifth.

The primary culprit is rarely a lack of passion or a poor product; it is almost always a failure to master the financial mechanics of the business. Whether you are a creative freelancer, a tech innovator, or a retail shop owner, the following financial pitfalls are the most common—and most dangerous—traps for the uninitiated.

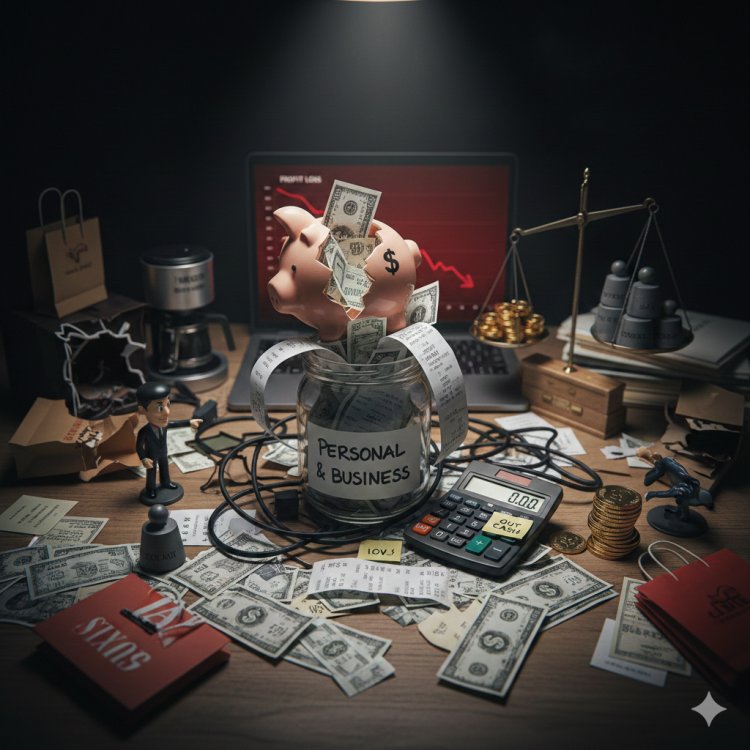

1. The Fatal Flaw: Mixing Personal and Business Finances

The most common mistake made by solo entrepreneurs and small business owners is the "one big pot" mentality. When you fail to separate your personal bank account from your business account, you create a transparency nightmare.

Why it’s dangerous:

-

Tax Confusion: When tax season arrives, trying to remember if a specific dinner was a client meeting or a birthday party is a recipe for an audit.

-

Legal Vulnerability: If your business is a separate legal entity (like an LLC or Ltd), mixing funds can lead to "piercing the corporate veil," making you personally liable for business debts.

-

Inaccurate Scaling: You cannot truly know if your business is profitable if your grocery bills and Netflix subscriptions are masking your actual operating margins.

The Fix: Open a dedicated business checking account and credit card from day one. Pay yourself a set salary or a scheduled "owner’s draw" rather than dipping into the till whenever you need cash.

2. Underestimating the "Burn Rate" and Cash Flow Gap

Profit and cash flow are not the same thing. You can have $100,000 in signed contracts (profit on paper) but $0 in the bank because the clients haven't paid yet. This is the "Cash Flow Gap."

The Burn Rate Reality: New owners often underestimate how much it costs to keep the lights on while waiting for revenue to catch up. They hire too fast, rent overly expensive office spaces, or invest in premium software suites that they don't yet need.

The Fix: Perform a Break-Even Analysis. Calculate exactly how many units you need to sell—or how many hours you need to bill—just to cover your fixed costs. Always maintain a cash reserve equivalent to 3–6 months of operating expenses.

3. Neglecting the "Invisible" Costs of Growth

Growth is expensive. Ironically, many businesses go bankrupt because they are too successful too quickly. Rapid expansion requires more inventory, more staff, and more infrastructure before the new revenue actually hits the bank.

Common Overlooked Expenses:

-

Employee Onboarding: The cost of hiring is often 1.5x to 2x the base salary when you include taxes, benefits, and training time.

-

Taxes: Many new owners forget that they are now responsible for both the employer and employee portions of social security or national insurance.

-

Maintenance: Equipment breaks. Software subscriptions increase in price. Cyber-security needs become more complex as you grow.

4. Poor Pricing Strategies: The Race to the Bottom

Many new business owners suffer from "Imposter Syndrome." To win clients, they set their prices lower than the competition. While this might get you customers, it often results in a business that is "busy but broke."

The Math of Bad Pricing: If your margin is razor-thin, a single mistake or a slight increase in supplier costs can turn a profitable month into a loss. Furthermore, it is incredibly difficult to raise prices on existing customers once you have anchored them to a "cheap" rate.

The Fix: Price for the value you provide, not the hours you work. Factor in your overhead, your desired profit, and a "buffer" for market fluctuations. It is better to have fewer high-quality clients than a mass of low-paying ones that drain your resources.

5. Ignoring Data and Bookkeeping

You cannot manage what you do not measure. Many entrepreneurs treat bookkeeping as a "year-end chore" for their accountant. By the time the accountant sees the books in April, the financial mistakes made in July are already irreversible.

The Importance of Real-Time Data: Financial statements—specifically the Balance Sheet, the P&L (Profit and Loss), and the Cash Flow Statement—are the "dashboard" of your business. Driving a business without looking at these is like driving a car with a blacked-out windshield.

The Fix: Use cloud-based accounting software. Dedicate at least one hour a week to reviewing your numbers. If you can afford it, hire a part-time bookkeeper or a fractional CFO to provide professional oversight.

6. Over-Investing in Non-Essentials

In the age of social media, there is a massive pressure to "look" like a successful business owner. This leads to spending capital on fancy websites, luxury office furniture, or high-end branding packages before the business has even proven its core concept.

The "Vanity Metric" Trap: Spending money to impress others is the fastest way to deplete your startup capital. Your customers care about the solution you provide, not the thread count of your office chairs.

The Fix: Practice "Lean Startup" principles. Invest only in things that directly contribute to revenue generation or product quality. Every dollar spent should have a clear, projected Return on Investment (ROI).

7. Inadequate Tax Planning

Tax debt is one of the few liabilities that can follow a business owner for life. Many new owners treat the total amount of a client’s payment as "their money," forgetting that a significant percentage belongs to the government.

The Fix: Set up a separate "Tax Savings" account. Every time a payment comes in, immediately move 20–30% (depending on your local jurisdiction) into that account. It’s not your money; you are simply holding it for the tax authorities.

8. Lack of an Exit or Contingency Plan

What happens if the market shifts? What happens if you get sick? Many business owners operate on the assumption that the current trajectory will continue forever.

The Financial Safety Net: Financial mismanagement often stems from a lack of "what-if" planning. This includes failing to secure proper business insurance (liability, professional indemnity, etc.) or failing to diversify revenue streams.

Conclusion: The Path to Financial Mastery

Running a business is a marathon of discipline. The most successful entrepreneurs are those who respect the math as much as they respect the mission. By separating your finances, monitoring your cash flow, pricing for profit, and planning for taxes, you move from being a "job owner" to a true "business owner."

Financial mistakes are inevitable, but they don't have to be terminal. The key is to catch them early, learn the lesson, and adjust the strategy. Your business's survival depends not on how much money you make, but on how much money you keep and how wisely you deploy it.

What's Your Reaction?