The Ultimate Guide to Credit Scores: Common Myths Debunked

Master your financial future by uncovering the truth behind credit scores. We debunk 20+ common myths about credit reporting, debt, and lending to help you build a perfect score.

In the modern global economy, few three-digit numbers carry as much weight as your credit score. It is the silent gatekeeper of your financial aspirations. Whether you are a young professional in New York looking to rent an apartment, an entrepreneur in London seeking a business loan, or a family in Sydney applying for a mortgage, your credit score is the primary metric used to judge your reliability.

However, despite its importance, the world of credit reporting is shrouded in mystery. This lack of transparency has birthed a massive ecosystem of misinformation. Myths about what helps, what hurts, and what is completely irrelevant to your score circulate through social media, family dinners, and even some professional financial circles.

To achieve true financial freedom, you must separate fact from fiction. This comprehensive guide dismantles the most persistent credit score myths, providing you with the clarity needed to navigate the financial landscape with confidence.

Section 1: The Basics of Credit Score Mechanics

Before we dive into the myths, it is essential to understand what a credit score actually is. At its core, a credit score is a mathematical representation of your "creditworthiness." It tells lenders how likely you are to pay back borrowed money based on your past behavior.

The two major scoring models—FICO and VantageScore—calculate these numbers using data from credit bureaus. While the algorithms are proprietary, they generally focus on five key areas:

-

Payment History: Have you paid your bills on time?

-

Amounts Owed (Credit Utilization): How much of your available credit are you using?

-

Length of Credit History: How long have your accounts been open?

-

New Credit: How many accounts have you opened recently?

-

Credit Mix: Do you have a diverse range of accounts (cards, loans, etc.)?

Section 2: Debunking the Top Credit Myths

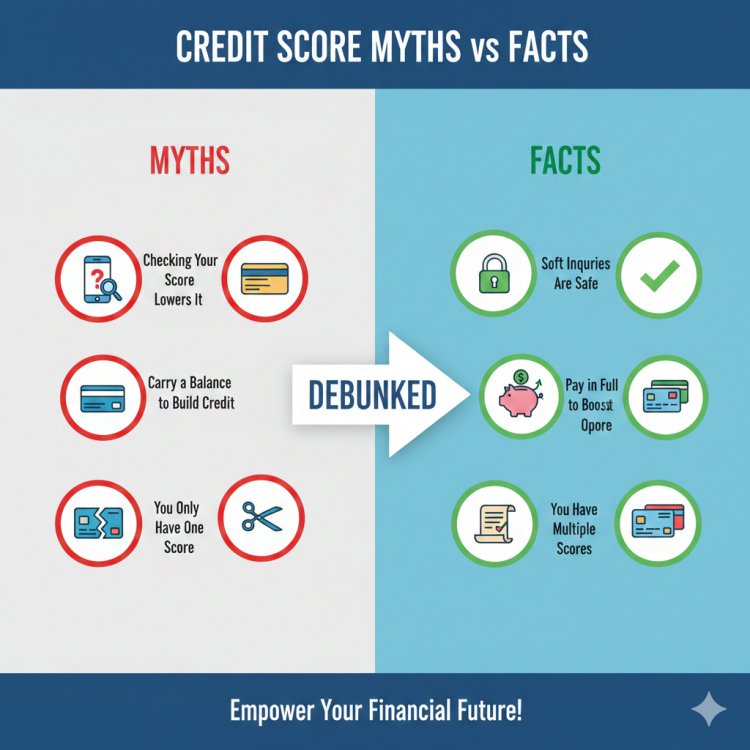

Myth 1: Checking your own credit score lowers it.

This is perhaps the most damaging myth because it discourages people from monitoring their financial health. The Fact: There are two types of credit inquiries: "hard" and "soft." A hard inquiry happens when a lender checks your credit to make a lending decision (like a mortgage application). This can lower your score slightly. A soft inquiry occurs when you check your own score, or when an employer or insurance company does a background check. Soft inquiries have zero impact on your credit score.

Myth 2: Carrying a balance on your credit card helps your score.

Many people believe that leaving a small amount of debt on their card every month shows "activity" and boosts their score. The Fact: Carrying a balance does not help your score; it only costs you money in interest. To maximize your score, you should aim for a low credit utilization ratio (ideally under 10%). Paying your balance in full every month shows you are a responsible borrower and keeps your interest expenses at zero.

Myth 3: Closing old accounts will improve your score.

It seems logical: if you aren't using an old card, closing it should "clean up" your profile. The Fact: Closing an old account can actually hurt you in two ways. First, it reduces your total available credit, which increases your credit utilization ratio. Second, it can shorten the "average age" of your credit history. Length of history is a significant factor in your score; therefore, keeping old, no-fee accounts open is usually beneficial.

Myth 4: You only have one credit score.

People often ask, "What is my score?" as if there is a single definitive number. The Fact: You have dozens of scores. Not only are there different bureaus (Equifax, Experian, TransUnion), but there are different versions of the FICO and VantageScore models. A car dealer might use a version of FICO specifically tuned for auto loans, while a mortgage lender uses a different version.

Myth 5: Your income level affects your credit score.

It is a common misconception that a higher salary automatically leads to a higher credit score. The Fact: Credit bureaus do not know how much money you make. Your income is not a factor in your credit score. While a high income makes it easier to pay bills on time (which helps your score), the number itself is strictly based on your debt management behavior, not your wealth.

Myth 6: Debt is always bad for your credit score.

In some cultures, any form of debt is seen as a failure. The Fact: To have a high credit score, you must have a history of managing debt. A person with zero debt and no credit history often has a "thin file," making it difficult for them to get a loan. The key is not to avoid debt, but to manage it responsibly.

Section 3: Financial Behavior and Your Score

The Myth of the "Debit Card Boost"

Many people believe that using a debit card responsibly will build their credit score. This is false. Debit cards pull money directly from your bank account; they are not a line of credit. Therefore, they are not reported to credit bureaus. If you want to build credit, you must use a credit card or a loan.

Employment and Credit

Does being unemployed hurt your score? Directly, no. Credit reports do not list your employment status. However, the loss of income may lead to missed payments or higher credit utilization, which will then impact the score.

The "Blacklist" Myth

There is no such thing as a permanent "blacklist" at credit bureaus. While negative information like late payments or bankruptcies stays on your report for 7 to 10 years, their impact diminishes over time. You can always rebuild your credit through consistent, positive behavior.

Section 4: Strategic Steps to Improve Your Credit

Now that we have cleared the air, how do you actually move the needle?

-

Automate Your Payments: Payment history is 35% of your FICO score. One late payment can tank a high score. Set up autopay for at least the minimum amount to ensure you never miss a deadline.

-

Request Credit Limit Increases: If you have been a good customer, ask your bank to increase your credit limit. If your spending stays the same but your limit goes up, your utilization ratio drops, which often leads to a score increase.

-

Diversify Your Credit Mix: If you only have credit cards, taking out a small personal loan or an installment loan can show lenders you can handle different types of debt.

-

Dispute Errors: Statistics show that a significant percentage of credit reports contain errors. Check your reports annually for accounts you didn't open or incorrect late payment markers.

Conclusion: Empowerment Through Accuracy

Your credit score is not a reflection of your character or your worth as a person. It is a tool—a financial resume that speaks to institutions on your behalf. By ignoring the myths and focusing on the data-driven reality of credit scoring, you take the power back from the banks and put it into your own hands.

Whether you are starting from scratch or recovering from past mistakes, the path forward is the same: stay informed, stay disciplined, and always double-check the "financial advice" you hear on the street.

What's Your Reaction?