How to Start Saving Money When You’re Living Paycheck to Paycheck

Living paycheck to paycheck doesn’t mean you can’t save. This guide shows you practical, step-by-step strategies to take control of your finances—starting small, building an emergency fund, automating savings, and boosting income. Learn how to cut unnecessary expenses, fight inflation, and adopt the wealthy mindset that transforms financial stress into financial freedom.

Introduction: The Global Struggle With Savings

Living paycheck to paycheck is no longer just a problem in developing nations. In fact, studies show that over 60% of Americans and 40% of Europeans admit they would struggle to cover a $1,000 emergency expense. High rent, rising inflation, credit card debt, and lifestyle inflation eat away at income—even in wealthy countries.

But here’s the good news: you can save money even with a tight budget. Saving isn’t just about having excess income; it’s about discipline, systems, and mindset. Let’s break down how you can move from paycheck-to-paycheck survival into consistent savings, no matter your income level.

1. The Pay-Yourself-First Rule

The number one mistake paycheck-to-paycheck households make is saving what’s left over—often nothing.

Instead, adopt the Pay Yourself First strategy:

-

As soon as your paycheck lands, transfer a set percentage (even 5%) into savings.

-

Automate the transfer to remove temptation.

Example: If you earn €2,000/month, setting aside just €50 monthly builds €600 a year—without even noticing.

2. Track Every Dollar (or Euro, Pound, Yen)

You can’t save what you can’t measure. Most people underestimate their spending by 20–30%.

Practical steps:

-

Use budgeting apps like Mint, YNAB, or Monzo.

-

Review the last 30–60 days of expenses.

-

Identify “leaks”: subscriptions, daily coffee, Uber rides, dining out.

Cutting just $5/day of waste = $150/month → $1,800/year in potential savings.

3. Apply the 50/30/20 Rule (Modified for Tight Budgets)

-

50% Needs: Rent, groceries, transport, utilities

-

30% Wants: Entertainment, dining, shopping

-

20% Savings/Debt

If you’re paycheck to paycheck, start with 5–10% savings. Don’t aim for perfection; focus on progress and consistency.

4. Build an Emergency Cushion First

Before investing, focus on short-term security.

Target: $500–$1,000 emergency fund.

Why? Because without this, every small crisis (car repair, medical bill) pushes you into debt, undoing months of effort.

Once you hit $1,000, scale toward 3–6 months of expenses.

5. Cut “Silent Killers” of Savings

Developed countries have silent budget killers:

-

Credit card debt (20–30% interest wipes out wealth).

-

Impulse spending online (Amazon, fast fashion).

-

Food delivery apps (often double cooking costs).

Rule: If it doesn’t add long-term value, cut or reduce it. Redirect even half of those costs into savings.

6. Boost Your Income (The Game-Changer)

Cutting expenses has limits. Boosting income transforms your savings ability. Consider:

-

Freelancing (writing, design, tutoring, coding).

-

Selling skills on Fiverr/Upwork.

-

Renting out spare rooms (Airbnb).

-

Side hustles: affiliate marketing, e-commerce, delivery jobs.

Even an extra $200/month accelerates your savings journey dramatically.

7. Automate Savings and Bills

Automation = discipline without effort.

-

Set up automatic transfers to savings on payday.

-

Automate bill payments to avoid late fees.

-

Use “round-up apps” that save spare change from purchases.

This ensures saving happens before spending.

8. Leverage Employer Benefits (Developed Nations Advantage)

If you’re in the U.S., U.K., or EU, your employer may offer:

-

401(k) match (U.S.)

-

Pension contributions (U.K./EU)

-

Stock purchase plans

Always take advantage of “free money” from employers. It’s an instant boost to savings.

9. Inflation-Proof Your Savings

Inflation erodes idle cash. In 2022–2023, inflation in the U.S. and Europe reached record highs.

Protect yourself by:

-

Keeping savings in high-yield accounts (2–5% interest).

-

Using money market funds (MMFs).

-

Gradually shifting into index funds once your emergency cushion is secure.

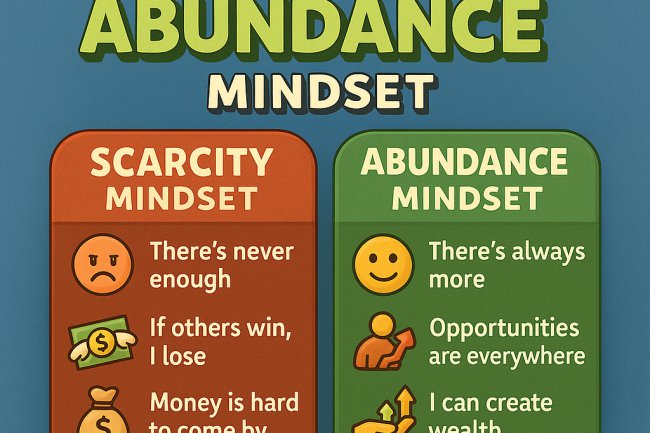

10. Change Your Money Mindset

The wealthy view money differently:

-

Money is a tool, not just income.

-

Savings = buying freedom, not sacrifice.

-

Every small deposit builds wealth habits.

Even €20/week invested in your future is a step toward breaking free from the paycheck cycle.

Case Study 1: Sarah in London

-

Salary: £2,200/month

-

Lived paycheck to paycheck.

-

Started with 5% auto-saving (£110/month).

-

Cut £80 in monthly subscriptions.

-

Side hustle: Freelance writing, adding £250/month.

Result: Within 1 year, Sarah built a £4,000 emergency fund and started investing in an ISA.

Case Study 2: John in New York

-

Salary: $3,500/month

-

Struggled with credit card debt.

-

Adopted debt snowball method (paying smallest debts first).

-

Used side income ($200/month tutoring) fully for debt repayment.

-

After 18 months, cleared $7,000 in debt and built a $1,500 emergency fund.

Step-by-Step Action Plan

-

Track every expense for 30 days.

-

Start with a mini emergency fund ($500–$1,000).

-

Automate a small savings transfer each payday.

-

Cut 2–3 non-essential spending habits.

-

Boost income with a side hustle.

-

Use savings for security first, then investing.

-

Stay consistent—small steps compound into big results.

Final Thoughts

Saving while living paycheck to paycheck may feel impossible—but it isn’t. The key is discipline, mindset, and consistency. Start small, automate the process, and focus on progress, not perfection.

Remember: every wealthy individual started somewhere. They didn’t wait for the “perfect time”—they started with what they had.

Want to go deeper? Read our full Global Wealth Blueprint and discover how to protect, grow, and multiply your money: Wealth Insights Global.

What's Your Reaction?