Vision Boards & Money Goals: The Ultimate Practical Guide to Financial Manifestation

Master your finances with our comprehensive guide on Vision Boards & Money Goals. Learn the science of visualization, practical design tips, and professional wealth-building strategies for all ages.

Introduction: The Intersection of Imagery and Economics

The concept of a vision board is often relegated to the realm of "wishful thinking" or aesthetic hobbies. However, when applied to the rigorous world of financial management, the vision board becomes a cognitive tool of immense power. At its core, a vision board is a spatial representation of your intentions. For money goals, it serves as a bridge between the abstract numbers in a bank account and the tangible reality of the life you wish to lead.

Financial success is rarely an accident. It is the result of sustained focus, specific habits, and a clear understanding of one’s "why." This guide explores how to marry the creative process of vision boarding with the analytical process of financial goal setting to create a roadmap for prosperity that appeals to everyone—from students and young professionals to retirees and seasoned investors.

The Science Behind Visualization

To understand why vision boards work for money goals, one must look at the Reticular Activating System (RAS) in the human brain. The RAS acts as a filter for the millions of bits of data we perceive daily. By consistently viewing a vision board, you "program" your RAS to notice opportunities related to your financial goals that you might otherwise overlook—a job opening, an investment tip, or a way to save money on a major purchase.

Furthermore, neuroplasticity suggests that our brains can be rewired through consistent mental rehearsal. When you visualize financial success, your brain begins to treat those goals as attainable realities rather than distant fantasies. This reduces the "fear response" often associated with high-stakes financial decisions and replaces it with a proactive, solution-oriented mindset.

Phase 1: Defining Your Financial North Star

Before placing a single image on a board, you must define what money represents to you. Is it security? Is it the freedom to travel? Is it the ability to provide for your family or donate to causes you care about?

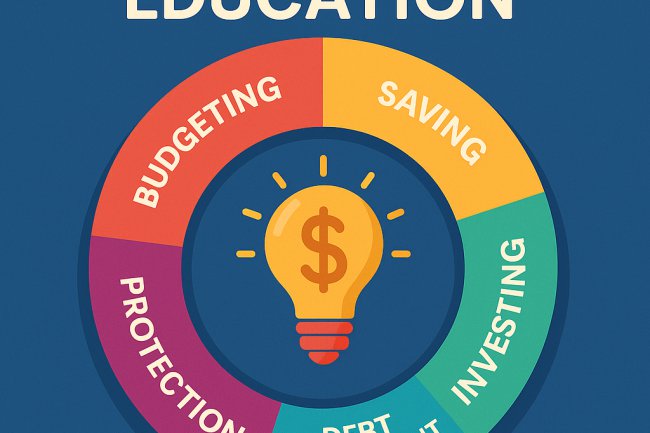

Categorizing Your Money Goals

-

Immediate Security: Building an emergency fund, paying off high-interest debt, and ensuring basic needs are met without stress.

-

Lifestyle Upgrades: Purchasing a home, upgrading your vehicle, or funding a hobby.

-

Future Growth: Retirement accounts, stock market investments, and diversified portfolios.

-

Legacy and Impact: Education funds for children, philanthropic endeavors, and generational wealth.

Phase 2: The Practical Construction of Your Board

A money-focused vision board should be more than just pictures of dollar signs. It should be a narrative of your financial journey.

Physical vs. Digital Boards

-

Physical Boards: The act of cutting and pasting provides a tactile connection to your goals. Placing a physical board in a high-traffic area of your home ensures constant subconscious reinforcement.

-

Digital Boards: Using software or graphic design tools allows for easy updates and the ability to set your board as a desktop or phone wallpaper. This is ideal for professionals who spend significant time on digital devices.

Essential Elements to Include

-

Specific Numbers: Do not just put a picture of a house; put the specific down-payment amount you need to save.

-

Representations of Work: Money is usually a byproduct of value creation. Include images that represent your professional growth, a promotion, or the launch of a business.

-

Emotional Anchors: Include photos of the people or experiences that motivate you to stay disciplined with your budget.

Phase 3: Integrating the "SMART" Framework

To make your vision board truly practical, every image should correspond to a SMART goal: Specific, Measurable, Achievable, Relevant, and Time-bound.

-

Specific: Instead of "more money," aim for "$10,000 in a High-Yield Savings Account."

-

Measurable: Use milestones. If your goal is to be debt-free, represent the halfway point on your board to celebrate progress.

-

Achievable: While it is good to dream big, your board should include "stepping stone" goals to maintain momentum.

-

Relevant: Ensure your financial goals align with your personal values.

-

Time-bound: Attach dates to your images. "Homeowner by October 2027" is more powerful than "Homeowner someday."

Phase 4: Overcoming the Psychological Barriers to Wealth

Many individuals struggle with financial goals because of "money scripts"—unconscious beliefs about wealth formed in childhood. Common scripts include "money is the root of all evil" or "I am not good with numbers."

Your vision board serves as a tool for cognitive restructuring. By surrounding yourself with positive, empowering images of financial success, you begin to overwrite these limiting beliefs. You move from a "scarcity mindset" (worrying about what you lack) to an "abundance mindset" (identifying ways to grow).

Phase 5: Professional Applications and Wealth Management

For professionals, vision boards can be used to track career trajectories and business scaling.

-

Corporate Climbers: Include logos of companies you wish to work for or the title of the executive position you are targeting.

-

Entrepreneurs: Use the board to visualize your product in the hands of customers, your revenue targets for the fiscal year, and the culture of the team you want to build.

Phase 6: Maintenance and Evolution

A vision board is a living document. As you achieve goals, it is vital to update the board. This creates a "success loop" where your brain receives a dopamine hit from crossing off a goal, which then fuels the motivation to tackle the next one.

Review your board during your weekly or monthly budget check-in. This aligns your visual aspirations with your actual financial data, ensuring that your daily spending habits are supporting your long-term visions.

Conclusion: From Vision to Reality

The synthesis of vision boards and money goals is a powerful strategy for anyone looking to take control of their financial destiny. It combines the emotional drive of our dreams with the logical structure of financial planning. Whether you are 18 or 80, the process of clarifying your desires and visualizing your success is the first step toward achieving it.

Wealth is not merely about the balance in your bank account; it is about the ability to live life on your own terms. Use your vision board as your compass, your budget as your map, and your discipline as your fuel. The path to financial freedom is rarely a straight line, but with a clear vision, you will always know which way to turn.

What's Your Reaction?