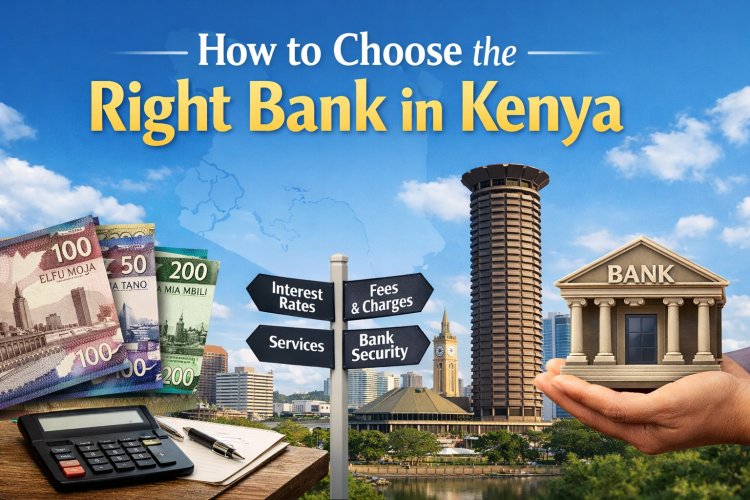

How to Choose the Right Bank in Kenya

Choosing the right bank in Kenya can shape your financial success. Learn how to compare banks based on fees, digital banking, loans, savings, security, customer service, and your personal financial goals.

Introduction

Choosing the right bank is one of the most important financial decisions an individual or business can make. In Kenya, where the banking sector is diverse, dynamic, and rapidly evolving, the choice can feel overwhelming. From long-established commercial banks to digital-first institutions and microfinance banks, consumers are presented with many options, each promising convenience, growth, and security.

Your bank is more than just a place to store money. It is a financial partner that influences how you save, spend, borrow, invest, and plan for the future. Whether you are a student opening your first account, a salaried professional managing income, an entrepreneur running a business, or a Kenyan living abroad seeking reliable financial connections back home, the right bank can simplify your life and support your goals.

This guide provides a comprehensive, practical, and unbiased approach to choosing the right bank in Kenya. It breaks down the key factors you should consider, explains how the Kenyan banking system works, and helps you align banking services with your personal or professional needs.

Understanding the Kenyan Banking Landscape

Kenya’s banking sector is regulated by the Central Bank of Kenya (CBK), which ensures stability, consumer protection, and compliance with financial laws. The sector includes:

-

Commercial banks

-

Microfinance banks

-

Islamic banks

-

Digital and mobile-led banks

-

Development and investment banks

Commercial banks dominate the market and offer a wide range of services such as savings accounts, current accounts, loans, mortgages, trade finance, and wealth management. Microfinance banks focus on financial inclusion, targeting small businesses and low-income earners. Islamic banks operate under Sharia-compliant principles, avoiding interest-based products.

In recent years, technology has reshaped banking in Kenya. Mobile money integration, especially with M-Pesa, online banking platforms, and app-based services, has made banking more accessible than ever before. Understanding this landscape helps you make informed comparisons rather than choosing a bank based on brand name alone.

Step One: Identify Your Banking Needs

The first and most important step in choosing the right bank is understanding your own needs. Different banks excel in different areas, and no single bank is perfect for everyone.

Personal Banking Needs

If you are an individual, consider the following:

-

Are you looking for a basic savings or current account?

-

Do you receive a salary and need payroll services?

-

Are you saving for short-term or long-term goals?

-

Do you need access to loans, overdrafts, or credit cards?

-

How important is mobile and online banking to you?

Business Banking Needs

For entrepreneurs and business owners:

-

Do you need a business current account?

-

Will you require working capital or business loans?

-

Do you deal with suppliers or clients internationally?

-

Do you need merchant services such as card payments or paybill integration?

-

Is relationship management and advisory support important to you?

Special Categories

Some banks offer tailored products for:

-

Students and young professionals

-

SMEs and startups

-

Corporates

-

Diaspora customers

-

High-net-worth individuals

Clarifying your category and priorities narrows down your options significantly.

Step Two: Compare Bank Fees and Charges

Bank fees can quietly erode your money if you are not careful. In Kenya, banks charge various fees including:

-

Account maintenance fees

-

ATM withdrawal fees

-

Mobile and online transaction fees

-

Over-the-counter transaction fees

-

Loan processing and insurance fees

When comparing banks, request or download their tariff guides. Pay close attention to:

-

Monthly account charges

-

Cost of frequent transactions

-

Penalties for minimum balance breaches

A bank with lower fees may be more suitable for day-to-day banking, especially if you make frequent transactions.

Step Three: Evaluate Digital and Mobile Banking Services

Kenya is a global leader in mobile money, and modern banking must integrate seamlessly with digital platforms. A good bank should offer:

-

A reliable mobile banking app

-

Integration with M-Pesa and other mobile wallets

-

Online banking for account management

-

Real-time transaction alerts

Digital banking convenience reduces the need to visit branches and saves time. Before choosing a bank, test their app reviews, ease of use, and reliability.

Step Four: Consider Accessibility and Convenience

Accessibility plays a major role in banking satisfaction. Consider:

-

Branch network near your home or workplace

-

ATM availability and reliability

-

Customer support channels

If you travel frequently or live outside major towns, a bank with a strong national ATM network and efficient digital services may be ideal.

Step Five: Assess Customer Service Quality

Good customer service builds trust and reduces stress when issues arise. Indicators of strong customer service include:

-

Responsive call centers

-

Knowledgeable relationship managers

-

Clear communication

-

Efficient complaint resolution

You can gauge service quality by reading customer reviews, asking for referrals, or interacting with bank staff before opening an account.

Step Six: Review Savings and Investment Options

If growing your money is a priority, compare:

-

Savings account interest rates

-

Fixed deposit options

-

Investment-linked products

-

Wealth management services

Some banks offer competitive interest rates but limit withdrawals, while others prioritize flexibility. Choose based on your financial discipline and goals.

Step Seven: Understand Loan and Credit Facilities

Access to credit is a key reason many people choose a particular bank. Look into:

-

Personal loans

-

Business loans

-

Mortgages

-

Asset financing

-

Credit cards and overdrafts

Compare interest rates, repayment periods, approval timelines, and flexibility. A bank that understands your income pattern or business model may offer better terms.

Step Eight: Security and Trustworthiness

Your bank should protect your money and personal information. Consider:

-

Compliance with CBK regulations

-

Deposit protection under the Kenya Deposit Insurance Corporation

-

Fraud prevention measures

-

Transparency in communication

Established banks often have stronger security frameworks, but newer digital banks may also offer advanced technology-driven protections.

Step Nine: Specialized Banking Options

Kenya offers specialized banking services that may suit unique needs:

-

Islamic banking for Sharia-compliant finance

-

Diaspora banking for Kenyans abroad

-

SME-focused banking for small businesses

-

Green and sustainable finance options

Choosing a bank that aligns with your values or circumstances enhances long-term satisfaction.

Step Ten: Think Long-Term

Your financial needs will evolve over time. A good bank should be able to grow with you, offering:

-

Career-stage products

-

Business expansion support

-

Investment and retirement planning

-

International banking services

Switching banks frequently can be costly and inconvenient, so consider future needs when making your choice.

Common Mistakes to Avoid When Choosing a Bank

-

Choosing a bank solely based on popularity

-

Ignoring hidden fees

-

Overlooking customer service quality

-

Failing to read terms and conditions

-

Not reviewing digital capabilities

Being informed helps you avoid these pitfalls.

Final Thoughts

Choosing the right bank in Kenya is a strategic decision that affects your financial health, convenience, and peace of mind. By understanding your needs, comparing options carefully, and thinking long-term, you can select a bank that supports your goals rather than complicates them.

Kenya’s banking sector offers something for everyone. The right choice is not about finding the biggest or most popular bank, but the one that aligns best with your lifestyle, profession, and financial vision. Take your time, ask questions, and make a decision rooted in clarity and purpose.

A well-chosen bank is not just a service provider. It is a partner in your financial journey.

What's Your Reaction?