The Importance of Financial Education in Our School Curriculum

The importance of financial education in school curricula, exploring global benefits, key topics to teach, and how financial literacy empowers future generations.

Introduction

Across the globe, societies are facing growing financial complexity. From digital banking and mobile money to credit systems, taxation, insurance, investments, and entrepreneurship, financial decisions have become an unavoidable part of daily life. Yet, despite the central role money plays in individual well-being and national development, financial education remains largely absent or insufficient within most school curricula worldwide.

This gap has serious consequences. Young people graduate from school academically qualified but financially unprepared. Many enter adulthood without understanding how to budget, manage debt, save, invest, or protect themselves from financial exploitation. The result is widespread financial stress, poor decision-making, chronic debt, and long-term economic vulnerability.

This article argues that financial education should be a core, compulsory component of school curricula globally. It explores why financial literacy matters, what should be taught at different educational levels, the long-term benefits for individuals and nations, and how schools can effectively implement financial education for a global audience.

Outline of the Article

-

Understanding Financial Education

-

The Global Financial Literacy Crisis

-

Why Schools Are the Ideal Platform for Financial Education

-

Financial Education and Life Skills Development

-

The Role of Financial Education in Reducing Poverty and Inequality

-

Financial Education and Mental Well-being

-

Preparing Students for the Modern Global Economy

-

Financial Education and Responsible Citizenship

-

What Should Be Taught in Primary Schools

-

What Should Be Taught in Secondary Schools

-

What Should Be Taught in Higher Education and Vocational Training

-

Teaching Methods and Curriculum Integration

-

The Role of Governments, Educators, and Institutions

-

Challenges in Implementing Financial Education

-

Long-Term Societal and Economic Benefits

1. Understanding Financial Education

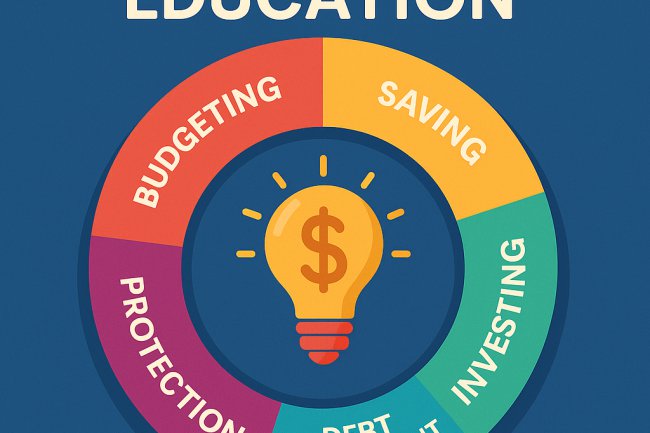

Financial education refers to the process of equipping individuals with the knowledge, skills, attitudes, and behaviors necessary to make informed and effective financial decisions. It goes beyond understanding money; it involves practical competence in managing income, expenses, savings, investments, risks, and long-term financial goals.

True financial education empowers learners to understand how money works in real-life contexts. It includes recognizing financial opportunities, evaluating risks, planning for the future, and adapting to economic changes. Importantly, financial education is not about wealth accumulation alone, but about financial stability, resilience, and responsible decision-making.

2. The Global Financial Literacy Crisis

Numerous international studies reveal alarmingly low levels of financial literacy across both developed and developing nations. Many adults struggle to understand interest rates, inflation, loans, or basic budgeting. This lack of knowledge contributes to rising household debt, poor retirement planning, susceptibility to scams, and financial exclusion.

Young people are particularly vulnerable. Without early financial education, they rely on trial-and-error learning, social media misinformation, or inherited financial habits that may be ineffective or harmful. The absence of structured financial learning in schools perpetuates cycles of poor financial decision-making across generations.

3. Why Schools Are the Ideal Platform for Financial Education

Schools provide a structured, inclusive, and equitable environment for learning. Unlike informal learning at home, school-based financial education ensures that all students, regardless of socio-economic background, receive foundational financial knowledge.

Introducing financial education early normalizes financial discussions and reduces stigma around money. Schools also allow for progressive learning, where financial concepts can be introduced gradually and reinforced as students mature cognitively and socially.

4. Financial Education and Life Skills Development

Financial education is a critical life skill. It enhances decision-making, critical thinking, problem-solving, and self-discipline. Students learn to set goals, delay gratification, evaluate trade-offs, and take responsibility for their choices.

These skills extend beyond money management. Financially educated individuals tend to plan better, cope more effectively with stress, and make informed life choices regarding careers, education, and family planning.

5. The Role of Financial Education in Reducing Poverty and Inequality

Financial education can play a transformative role in breaking cycles of poverty. While it does not replace structural economic reforms, it equips individuals with tools to maximize limited resources, avoid exploitative financial practices, and build financial resilience.

When integrated into school curricula, financial education promotes social mobility by giving all learners equal access to financial knowledge, regardless of family background.

6. Financial Education and Mental Well-being

Financial stress is a leading contributor to anxiety, depression, and family conflict worldwide. Poor money management often results in chronic stress and reduced quality of life.

Financial education helps individuals develop confidence and control over their finances. By understanding financial systems and planning ahead, people experience reduced uncertainty and improved psychological well-being.

7. Preparing Students for the Modern Global Economy

The global economy is increasingly interconnected, digital, and dynamic. Students must navigate online banking, digital currencies, global markets, and remote work opportunities.

Financial education prepares students to participate effectively in this evolving economic landscape, enhancing employability, entrepreneurship, and adaptability.

8. Financial Education and Responsible Citizenship

Financially literate citizens are better equipped to understand taxation, public spending, social security systems, and economic policies. This understanding fosters informed civic participation and accountability.

Financial education thus strengthens democratic engagement and supports transparent governance.

9. What Should Be Taught in Primary Schools

At the primary level, financial education should focus on foundational concepts:

-

Understanding money and its uses

-

Differentiating needs and wants

-

Basic saving habits

-

Simple budgeting concepts

-

Introduction to earning and sharing

Teaching should be practical, story-based, and age-appropriate.

10. What Should Be Taught in Secondary Schools

Secondary education should expand financial knowledge and introduce real-world applications:

-

Personal budgeting and expense tracking

-

Banking systems and financial institutions

-

Credit, loans, and interest

-

Saving and investment basics

-

Consumer rights and financial scams

-

Entrepreneurship and income generation

11. What Should Be Taught in Higher Education and Vocational Training

At advanced levels, financial education should prepare students for independence:

-

Advanced budgeting and financial planning

-

Debt management and credit scores

-

Taxes and legal financial obligations

-

Investments and risk management

-

Retirement planning

-

Business finance and entrepreneurship

12. Teaching Methods and Curriculum Integration

Financial education should be experiential, interactive, and contextual. Project-based learning, simulations, case studies, and real-life scenarios enhance understanding and retention.

Rather than existing as a standalone subject only, financial education can be integrated into mathematics, social studies, economics, and life skills courses.

13. The Role of Governments, Educators, and Institutions

Governments must prioritize financial education within national curricula and provide teacher training and resources. Educators play a crucial role in delivering accurate, unbiased financial knowledge.

Partnerships with financial institutions, NGOs, and international organizations can support curriculum development while maintaining ethical boundaries.

14. Challenges in Implementing Financial Education

Common challenges include limited curriculum space, lack of trained teachers, and resistance to curriculum reform. Additionally, ensuring content remains unbiased and culturally relevant is essential.

These challenges can be addressed through policy commitment, teacher development, and continuous curriculum evaluation.

15. Long-Term Societal and Economic Benefits

The benefits of financial education extend beyond individuals:

-

Reduced household debt

-

Increased savings and investment

-

Stronger entrepreneurial culture

-

Reduced poverty levels

-

Improved mental health outcomes

-

Greater economic stability

-

More informed consumers

-

Enhanced workforce productivity

-

Improved retirement preparedness

-

Reduced reliance on social welfare

-

Greater financial inclusion

-

Increased economic resilience

-

Stronger civic engagement

-

Intergenerational wealth transfer knowledge

-

Sustainable national economic growth

Conclusion

Financial education is no longer optional; it is a global necessity. In a world defined by economic uncertainty and financial complexity, equipping young people with financial knowledge is an investment in individual dignity, social equity, and national prosperity.

Integrating comprehensive financial education into school curricula worldwide will empower future generations to make informed decisions, reduce economic vulnerability, and contribute meaningfully to sustainable development. The classroom is not just a place for academic learning; it is where financially capable, resilient, and responsible citizens are shaped.

What's Your Reaction?